Highlighting the urgency of extending the tax benefits for foreign investors under the Puerto Rico Incentives Code (Act 60) to all island residents, Paulson Puerto Rico joins the public discussion on this issue. It supports two legislative bills that, if signed into law, would represent a strategic and fundamental reform that would address several of the island’s most pressing tax challenges.

House Bill 501 (PC 501) and Senate Bill 488 (PS 488), together called the Tax Equality Bill, aim to ensure tax equity for all Puerto Rico residents, grow a sustainable and diverse economy, strengthen public policies against population decline, and secure the Government of Puerto Rico’s long-term fiscal stability.

“Under the existing tax incentive system, Puerto Ricans are penalized for investing,” said Rolando Padua, who, along with Rafael Cedeño Paulson, leads Paulson Puerto Rico, both as chief executive officers.

“The Tax Equality Bill, or PC 501, would create a more equitable and fair environment for investment on the island, which would help encourage the return of Puerto Ricans in the diaspora,” Padua added.

One of the proposed amendments to the Internal Revenue Code would set a special 4% tax on interest income, dividends, and long-term capital gains, applicable to all Puerto Rico residents.

“This is the most important change to boost economic growth, increase the population, and generate revenues for the Government of Puerto Rico.” Cedeño Paulson explained that the amendment—a relatively simple change to current legislation—would maximize the Incentive Code’s scope, making it more effective in accelerating positive results for the island.

“Currently, there are fewer than 3,000 active decrees under Act 60, providing a base for expanding the program and multiplying its economic and social benefits. With this, Puerto Rico would have the opportunity to strengthen investment and generate a multiplier effect in the economy,” Cedeño Paulson added.

Concerned that resident investors would not apply for a decree under Act 60, the executives saw an opportunity to enable more resident investors to apply for a formalized decree with the Puerto Rico Department of Economic Development and Commerce (DDEC). In this way, the period of years granted by a tax decree would be assured.

Similarly, nonprofit organizations that receive donations from resident investors would secure their current taxpayer base and expand it. They would also aim to increase the number of individual beneficiaries of Act 60 decrees in their donor base in subsequent years.

Commissioning of studies

To assess the benefits of the proposed law, the company commissioned studies, including those conducted by firms such as Estudios Técnicos, to prepare an analytical report on tax revenues under three hypothetical scenarios. They estimate that, with just the arrival of 1,000 to 2,000 new investors in Puerto Rico per year, tax revenues would increase by $1.4 billion to $5.2 billion over the next five years.

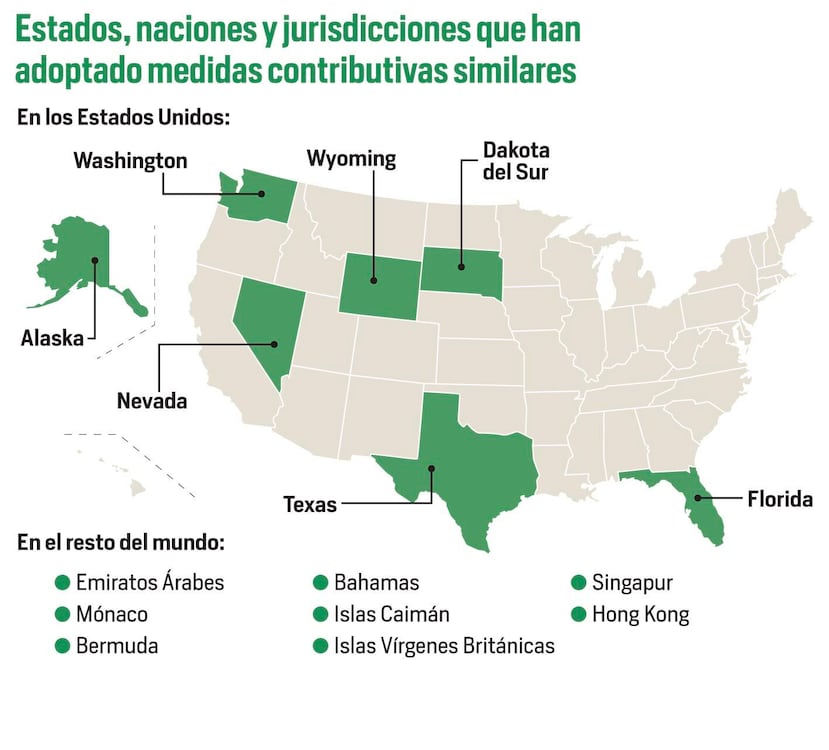

Cedeño Paulson explained that these estimates are extremely conservative compared to jurisdictions such as the state of Florida, which attracts around 350,000 new residents a year, drawn by its favorable fiscal environment and low taxes. The goal, he said, is for Puerto Rico to capture part of this migratory flow and convert it into local economic growth. In that context, he argued that the impact of the Government of Puerto Rico’s proposed measures would be cumulative and exponential. “In addition, although the rate in Florida on capital gains is 0%, there they have to pay federal taxes of up to 37%, unlike Puerto Rico,” Padua clarified.

Both executives emphasized that the approval of the measures contained in PC 501 would have an undeniable element of equity. They also noted that both the New Progressive Party and the Popular Democratic Party contemplated in their respective government platforms reducing the capital gains tax for residents and equalizing it to what foreign investors pay under Law 60.

An increase in revenues is anticipated.

PC 501 is part of the general tax reform discussion. It includes proposed legislation to reduce contributions to the salaried class. In addition, there are discussions to extend Law 60 with certain changes, including raising the capital gains rate from the current 0% to 4%. At the moment, the capital gains rate for Puerto Rico residents ranges from 15% to 24%.

To this end, the Legislature’s Budget Office (OPAL) recently published a fiscal report. The report indicates these measures could reduce General Fund revenue by an estimated $132 million. However, the analysis shows that, even under a conservative scenario, the initiative’s positive economic impact could generate more than $1 billion in revenue for the Government of Puerto Rico. This far exceeds the fiscal cost. Padua affirmed that capital gains taxes account for barely 1% of Puerto Rico’s government’s tax revenues.

“By reducing this tax, it would create a huge incentive for people, including many Puerto Ricans in the diaspora, to return and stay in Puerto Rico, increasing the tax base and, at the same time, generating jobs and economic activity,” he concluded.

---

This content was translated from Spanish to English using artificial intelligence and was reviewed by an editor before being published.

Te invitamos a descargar cualquiera de estos navegadores para ver nuestras noticias: